In the past decade, the microbiome has emerged as a gold mine of opportunity, particularly for companies seeking to innovate in consumer health and wellness. While traditional probiotics and their relation to gut health are well established, the potential of the microbiome goes far beyond traditional probiotics. This new frontier, encompassing the microbiome modulators psychobiotics, prebiotics, synbiotics, and postbiotics, is more than a trend — it doubles down on the efforts to discover metabolic pathways and modes of action for more specialized functions, such as enhancing cognitive function and reducing inflammation. For businesses looking to carve out a piece of this burgeoning market, the question is not if but how to dive into a sustainable business opportunity. Ingredient developers are by far the most active in microbiome modulation, given their interest in diversifying “-biotics” portfolios. They should focus on creating durable, versatile solutions, including partnerships for heat- and pH-resistant ingredients, coformulating with bioactives, and using machine learning to optimize ingredient discovery. Companies with existing microbiome solutions should consider expanding into emerging areas like the gut-brain axis, gut-skin health, infant nutrition, and healthy aging to stay competitive.

Beyond probiotics: Exploring the microbiome modulators

With four groups of emerging microbiome modulators — and even the advancement of probiotics themselves — you might wonder if one is better or more efficient than the other. Lux Research’s recent report delves into the benefits and applications of each type, revealing that there’s no one-size-fits-all solution. The choice depends on factors like mode of action, the host’s and their microbiome’s genetic composition, scientific validation, production scalability, degree of formulation challenges, regulatory hurdles, and consumer awareness.

Prebiotics and advanced probiotic strains, such as psychobiotics, are likely to dominate in the short term, especially in areas like gut and skin health and other related axes (gut-immune, gut-brain). In parallel, companies like Nestlé, Danone, Bel, and Fonterra are already experimenting with synbiotics and postbiotics, focusing on their stability, viability, and broader functionality in direct-to-consumer products.

Emerging key health impact areas

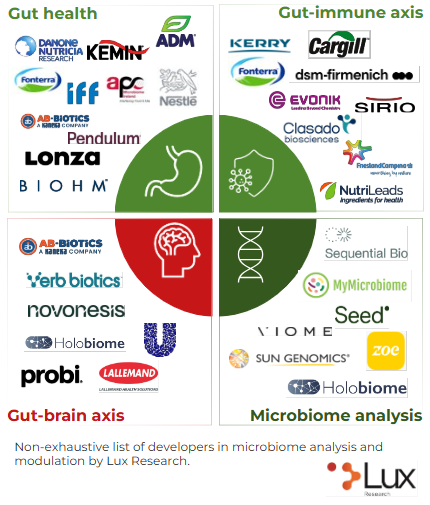

Innovations in early life nutrition through human milk oligosaccharides (HMOs), immune health, metabolic health, and the gut-brain axis are advancing, as evident from recent strategic partnerships and consumer product launches (see Figure 1). With demand for HMOs, even in adult nutrition, companies like IFF, Novonesis, and DSM-Firmenich are leading the charge, scaling up production and navigating regulatory approvals.

For the personal and home care players, note that a microbiome-friendly certification for your products would be a first step as an entrant. With several partnerships for the same, MyMicrobiome leads in analyzing the effects of formulations and textiles on retaining healthy skin.

Commercialization and global momentum

While probiotics and prebiotics emerge as solutions with relatively lower development challenges for applications targeting the gut and skin microbiome, developing cost-effective and scalable production methods without compromising efficiency can pose obstacles, opening opportunities for alternative production and formulation methods. The U.S., China, and Korea have the highest innovation momentum and highest level of product launches.

Next-generation sequencing, multiomics platforms, and advanced bioinformatics tools also accelerate progress in understanding microbiome complexity. These tools allow companies to analyze microbial diversity, discover beneficial ingredients, and study metabolic pathways. Some significant strategic partnerships like Unilever-Holobiome, Johnson & Johnson-Sequential, APC Microbiome-Nestlé, Tate & Lyle, Arla, and Fonterra hope to advance microbiome research and tap into new product possibilities. However, current microbiome analysis approaches lack standardized methods to monitor microbiota before and after interventions. This has led to B2B platforms like Sequential, Holobiome, Carbiotix, and Bio-Me analyzing host microbiome and building strain libraries to expedite development of new strains to incorporate in health and wellness products.

The path forward for the microbiome market

For the industry to mature, two steps are essential. First, standardized clinical trials must be expanded and should be supported by government grants, venture capital, and corporate funding. This step will ensure product efficacy and help build consumer trust in the novel products. Educating consumers about microbiome modulators and their potential benefits will also be vital for broader product adoption.

Second, AI-driven approaches are expected to provide deeper insights into microbiome-host interactions. By decoding these complex relationships and integrating multiomics data, AI can assist in ingredient discovery and subsequent identification of metabolic pathways, but black-box solutions should be considered unpredictable at this stage.

Lux Take

The microbiome market is on the cusp of a significant transformation, with opportunities that extend far beyond traditional probiotics. As research advances and consumer awareness grows, the potential for businesses to innovate and capture market share is immense. By focusing on product efficacy, scalable production, and consumer education, companies can unlock the full potential of the microbiome and stake their claim in this multibillion-dollar industry.