Back in 2018, we published a report about the fast-growing cellular agriculture space, focused on both cell-based meat and fermentation-derived proteins. Particularly, startup activity in the cell-based space has exploded over the past two years, with currently more than 45 startups spread across the globe working on cultivated meat. Given the fast pace at which the cell-based meat space is evolving, it is important for those who are interested to know how to approach this space when looking to invest or partner. In this blog, we will analyze recent developments, including funding, startup activity, key challenges, and opportunities in the cell-based meat space.

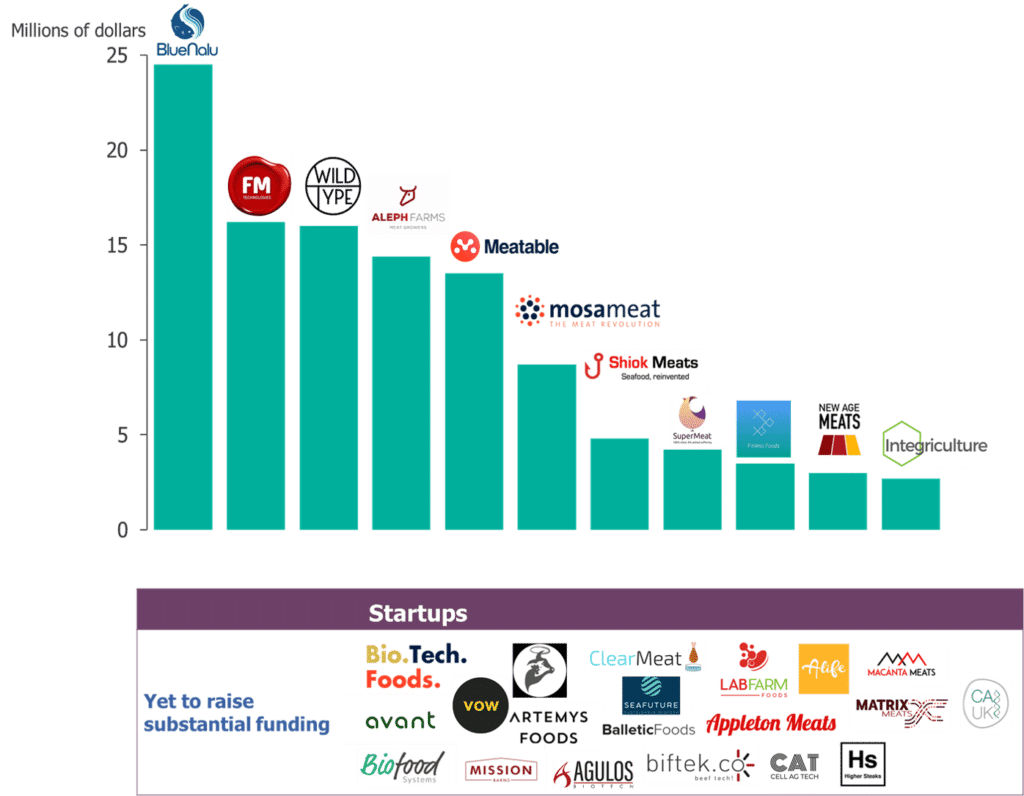

With more than $350 million raised in funding by cell-based meat startups, there is no dearth of investment in this space. Memphis Meats emerges as the front-runner, with a total funding of about $181 million. While most of the industry focus is on Memphis Meats’ noteworthy Series B funding in 2020, there are many other promising startups that have raised funding. In particular, BlueNalu, Aleph Farms, Future Meat, Wild Type, and MosaMeat have all raised Series A funding. Notably, most of these funding rounds have included participation from different strategic investors like Merck, Cargill, Nutreco, and M-Industry, in line with our prediction about the rise of corporate strategic investors in the cellular agriculture space. A number of other startups are more at an early stage or have just emerged out of stealth mode and have yet to raise any substantial funding, as depicted below in Figure 1.

Figure 1: Cell-based meat funding landscape covering startups other than Memphis Meats

(Source: Lux Research VC funding tool; only publicly available funding information is included)

Despite this cash flow, startups still have a long way to go in terms of scaling up production and commercializing their products, with numerous technical and regulatory challenges to overcome. Especially on the technology front, there are still several hurdles to be addressed, including but not limited to the following.

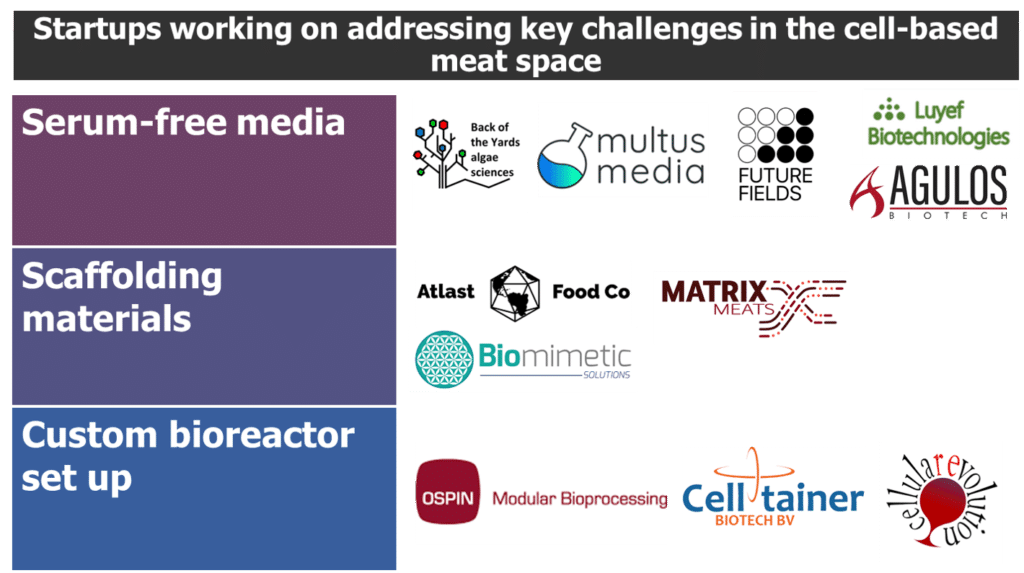

Serum-Free Media Development

Based on our interviews with cell-based meat developers, serum-free medium continues to be one of the most expensive roadblocks on the path to large-scale production of cell-based meat. Most startups claim to be developing their own proprietary serum-free medium variations; however, most have not yet succeeded in bringing down costs associated with added growth factors. To this end, startups like IntegriCulture are working toward creating a continuous flow system by co-culturing muscle stem cells and cells that produce growth factors in connected bioreactors to bring down costs. Another development in the space is the rise of startups focused mainly on optimizing cell-specific serum-free media. Such startups are open to a B2B model to work together with other startups for suitable media composition. Recent examples include Future Fields, Agulos BioTech, and Multus Media, with the latter employing fermentation-based approaches to produce growth factors. Given the utmost importance of cost-efficient growth media, we expect bigger players like Merck and Thermo Fischer Scientific as well as smaller startups to offer more personalized B2B approaches.

Scaffolding Materials

While most startups in the cell-based meat space are initially targeting minced meat products, which do not require scaffolding materials, the production of more structured meat pieces will necessitate the consideration of multiple factors, such as vascularization and complex scaffolding. Startups like Biomimetic Solutions, Matrix Meats, and Ecovative Design seem to be addressing this scaffolding issue for cell-based meat. In a recent development, Ecovative Design, a startup that develops mycelium-based scaffolding materials, announced a spinoff, Atlast Food Co., to solely focus on plant-based steak and cell-based products. Innovation in edible, biodegradable scaffolds will be a hot area as companies look to produce more steak-like meat structures in the future.

Bioreactor Setup

The design and optimization of bioreactors for cell-based meat production involves a number of key factors to consider, making it a complex process. While most developers employ in-house techniques for small-scale production, they typically face greater challenges when trying to scale up production. Eyeing the need to develop custom-made bioreactor setups, companies like Ospin Modular Bioprocessing offer dedicated bioprocess design and automated bioreactor setup services for cell-based meat production. U.K.-based CellulaREvolution develops bioreactors capable of continuous production of adherent cells, thus facilitating faster scale-up. Expect to see more such offerings related to bioreactor setup to expedite cell-based meat production beyond lab scale.

Figure 2: Startups working on addressing key challenges in the cell-based meat space

What to Look for in 2020 and Beyond?

Startups in this space are already looking to address some of the above-mentioned key challenges to take a step forward toward commercializing cell-based meat. Revisiting the commercialization roadmap that we published, here are some of the key milestones to look for within the coming five years:

Hybrid Products Are Likely to Be the First to Come to the Market

Developers initially focusing on hybrid products, for example, plant-based product mixed with cell-based fat or meat, are likely to gain commercial traction. Israeli startup Future Meat has announced the construction of a pilot plant to commercialize such hybrid products by 2021. Likewise, another startup, SuperMeat, has a recent patent application that outlines methods to develop hybrid products containing plant protein and cultured meat. An example is hybrid chicken-like sausage made from soy protein and wheat protein mixed with cultured fat. Hybrid products can be a viable step toward commercializing cell-based meat as well as a means to gain initial consumer acceptance. This also allows cell-based meat products to enter the market in different phases.

Startups Will Race Toward Pilot Plant Setup

With their infusions of cash, a handful of startups are looking to build their first pilot plant facilities as they look to move beyond lab-scale production. For instance, BlueNalu has an ambitious commercialization strategy and plans to construct a pilot facility to commercialize cell-based seafood in late 2021. Irrespective of the target product type, interested parties should closely monitor the efforts from Memphis Meats, Future Meat, BlueNalu, and others toward the successful construction of pilot plants, an immediate major milestone in the space.

Despite the current unknowns in terms of regulatory approval timelines and cost-efficient scale-up, cell-based meat will be an important part of the future of proteins, requiring the interplay of multiple industries to come to fruition. Those interested are encouraged to enter this landscape through strategic partnerships or investments but remain cognizant of the technical, commercial, and regulatory hurdles that startups need to negotiate to make cell-based meats a commercial reality.