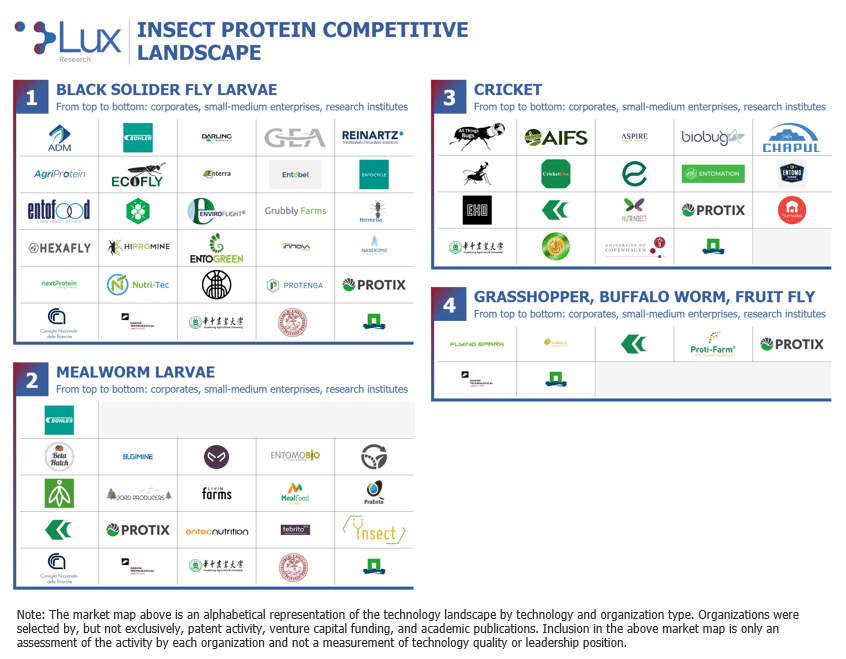

Interest in insect production is escalating across the globe as a promising strategy to capitalize on trends to minimize and valorize food waste and to support the increasing demand of alternative protein sources for food and animal feed markets. Accordingly, the space has become crowded with players, and the number of production facilities is multiplying by the year. While this has led to a universe of opportunities to capitalize on, understanding where and how to engage is not simple. One aspect of understanding this opportunity is insect choice. While the black soldier fly (BSF) continues to carry weight as a scalable option it is important to understand its competitive advantages while also remaining open to the diversity of insect alternatives available as selection remains an unified front.

Black Soldier Fly Interest Derives from Diverse Organic Waste Use

Commercial interest in BSF derives from its broad palatability of diverse organic wastes. Unlike other scaling insect platforms (e.g., mealworms), BSFs consume anything from food waste that contains animal byproducts to solids from municipal waste streams. While diversity in feedstock is important when exploring regional waste availability options, ensuring feed consistency maybe even more critical as scale is achieved. Producers like InnovaFeed are partnering with major ingredients players (e.g., ADM) to secure access to large waste streams. Alternatively, AgriProtein has identified an approach to combine various waste streams to produce a standardized feed substrate that has a consistent value of macronutrients to support insect growth. Another company looking to manage feedstock quality is Nutrition Technologies. It ferments feedstock sources to enhance insect feed conversion efficiency through improved nutrient availability and digestibility. This approach also decreases the potential for microbial contamination of feedstock, improves control over growing tray temperature through prevention of decomposition, and supports preservation. While BSF is leading the field diversity in strategy exists.

Ground-Based Insects Offer Ease of Management

Given mealworm beetles’ inability to fly, their production management is considered an advantage for scalability compared to BSF. This advantage enables the production process to be more easily automated, promoting increased efficiency and large-scale production. However, mealworms are pickier when it comes to feedstock. Most production facilities rely on spent grains and pre-consumer vegetable matter. Despite palatability restrictions, mealworms are primed for large-scale production. Of the producers in this group, Ÿnsect has emerged as a leader since announcing its $375 million Series C and plans for a 100,000 MT/yr protein production facility. The facility, expected to come online as early as 2022, will be the largest mealworm production facility in the world.

Cricket Producers Consider Alternative Options as the Feed Market Grows

Given that many cricket producers are focused on insect-based foods rather than the insect as an ingredient, the number of cricket producers worldwide is much larger than positioned here. Crickets are an exceptional food source, and as a result, the sector is experiencing interesting shifts as the feed market expands. For instance, U.S.-based Chapul announced in 2019 that it was pivoting from producing cricket-based protein bars to pursuing BSF production in Indonesia to target the aquaculture feed market. The company’s goal is to construct multiple facilities and produce 200,000 tons of BSF annually by 2023. This move highlights challenges in consumer perception around insect consumption regionally as well as the major market opportunity in fish meal alternatives for aquaculture production. Another major U.S.-based cricket producer, Aspire Food Group, is also producing abroad, with operations in Ghana and Mexico.

More Rarely Produced Insects Still Offer Niche Opportunities

Although grasshopper, buffalo worm, and fruit fly larvae encompass the less-targeted insect species, they are all exceptionally high in protein (reaching 70% protein content) and promising for food applications. For instance, Hargol FoodTech recently received a $3 million investment and claims that grasshoppers have a milder taste and are the most widely eaten insects in the world. Despite this, the length of the grasshopper life cycle limits production to 10 cycles per year, whereas Flying SpArk, which received an investment from the VC arm of Thai Union Group, claims the fruit fly can increase its body mass by 250 times in just seven days potentially increasing the number of production cycles. While these insect species each present unique advantages and disadvantages, the fact that the industry continues to develop provides niche attraction for further growth of the technology.

#LuxTake

Insects are a viable means of valorizing organic waste streams and offer an opportunity to capitalize on additional megatrends including circular economy, sustainable food systems, and protein alternatives. There is not one insect species that has emerged as the clear winner, despite the rise of BSF. Many companies continue to hedge bets across multiple insect species and you should do the same.