Do you believe you are doing insights right? Do you believe your work is truly consumer-led and human-centric?

Let’s take the anthropologist’s quiz.

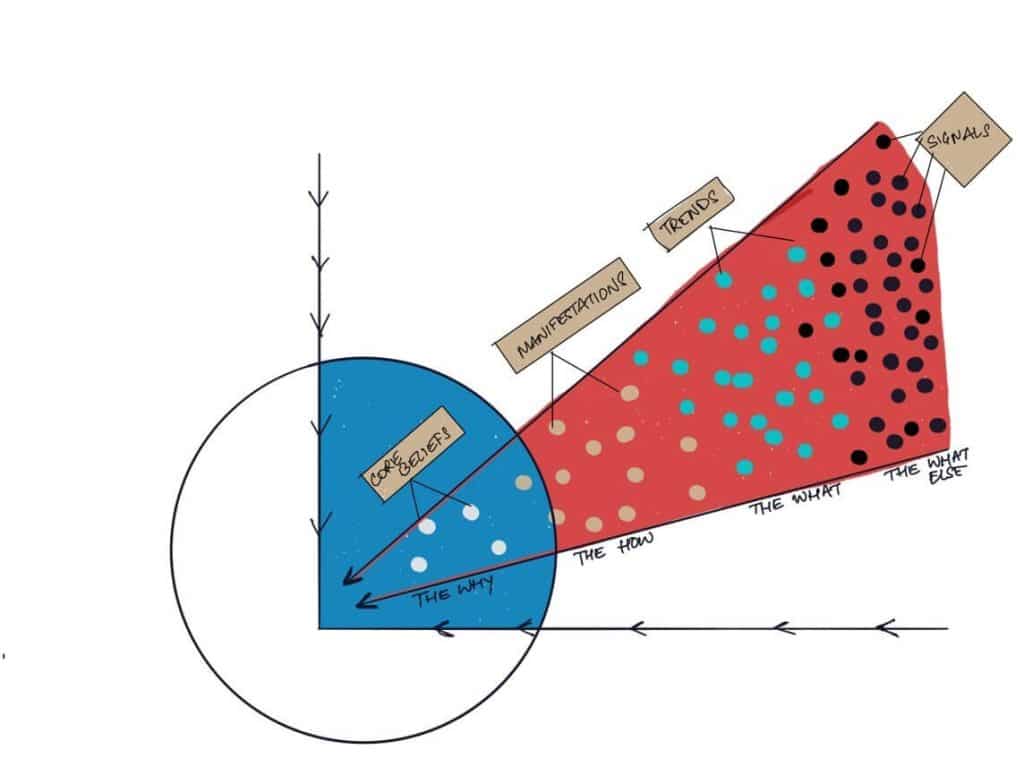

The chart below illustrates how a culture typically plays out. On the outer edge are ‘signals’ that indicate where a culture might be headed. Behind it are ‘trends’ which are nothing but more established signals that provide us with tactical direction as to the evolution of consumer behavior within that culture.

These ‘trends’ are typically what get talked about in syndicated trend reports and the media mainly because these are also topics that social media trackers tend to catch.

Behind these ‘trends’ are what we call ‘manifestations’. They are nothing but the things people do and say in order to live a trend – i.e. incorporate it into their lives in some form or the other. And behind those manifestations are the underlying implicit core beliefs of the consumer. The implicit belief systems are what ultimately drive and motivate human behavior within a culture.

To be truly human-centric, it is not enough to simply know of trends and manifestations. One must understand and decode the deep human ‘why’. The implicit beliefs that drive the consumer.

Every signal, trend, and manifestation you study must link back to an underlying implicit belief. If it doesn’t, then you lack human-centricity.

So how do you take the anthropologist’s quiz?

You ask yourself two key questions –

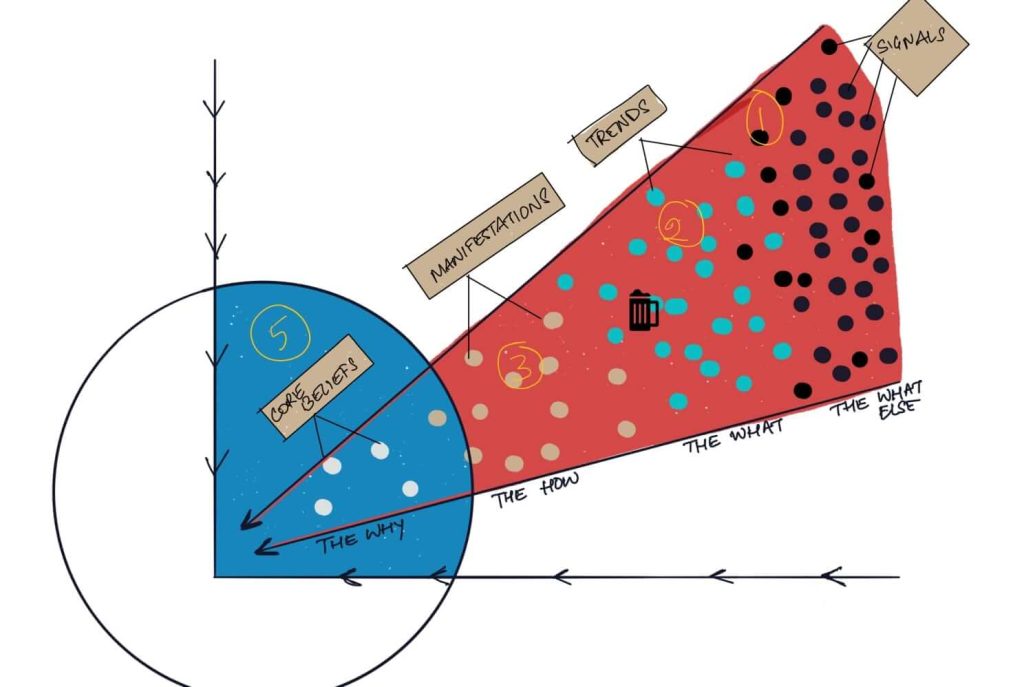

- In which ‘zone’ does your insights organizations spend the majority of its time? Signal tracking? Trend tracking? Talking manifestations – occasions, habits, behaviors? Or decoding belief and value systems, emotional and social jobs?

- Consequently, what ‘zone’ is most commonly discussed and researched by your organization when making decisions?

Give yourself a score of 5 if the answer is ‘core beliefs’ for either of these questions. A 3 if the answer is ‘manifestations’, a 2 if the answer is ‘trends’ and a 1 if the answer is ‘signals’.

If you scored a 10, you’re a legend. Send me a note and I want to learn how you achieved it because it is a massive achievement and it’s rare.

If you scored more than 7, you’re in pretty good shape. I’d be curious where the gaps are. Who or what might be holding you back from legendary status?

If you scored 5 or under, I have some bad news for you – you are anything but consumer-centric. In fact, by virtue of merely focusing on manifestations and trends, you are making your organization susceptible to constant disruption and analysis paralysis over time.

But do not be disheartened.

In my experience, it is quite difficult to make your insights organization human-centric. True human-centricity requires a level of sophisticated thinking and knowledge sharing across the insights organization, across seniority levels…which is often difficult to achieve. Those that do – their results do the talking.

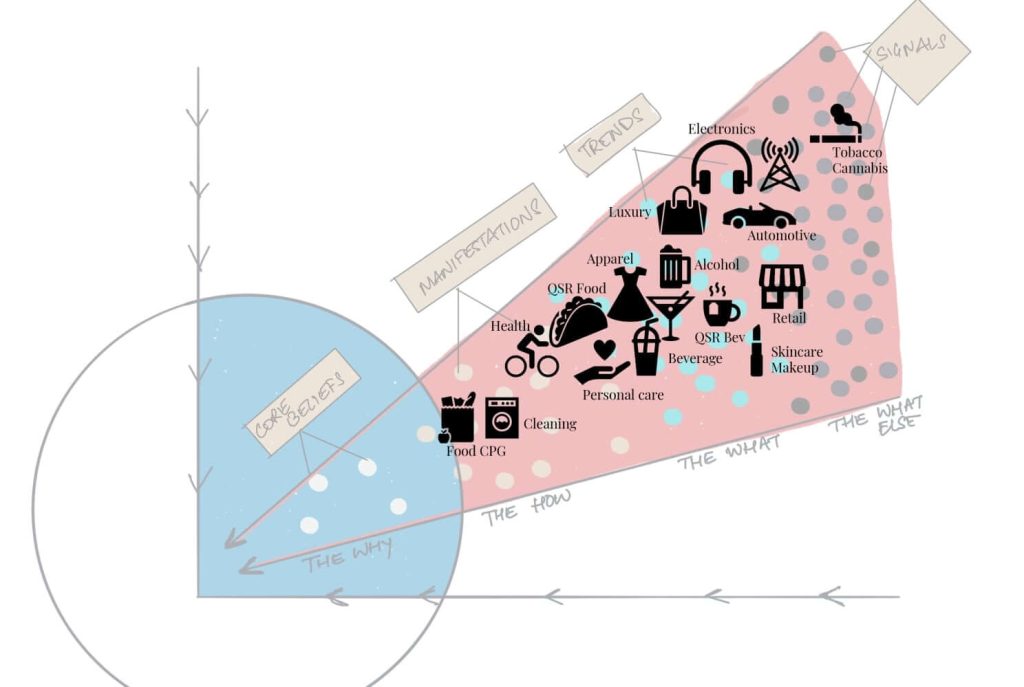

Just like all companies aren’t created equal. Neither are industries or categories. In fact, some categories by virtue of their history (highly competitive) tend to be far more sophisticated in their application of human centricity than others.

Below is my subjective take on how these categories tend to differ. It’s an assessment that is based on the hundreds of conversations I’m fortunate enough to have each year across insights and foresights leaders in the Fortune 1000.

The point of this assessment isn’t to fuss over exactly where each industry should lie on the chart. And yes, I’m very aware that there are many exceptions.

Rather, the point of this exercise is to highlight something that I think is often missed. In less mature and less human centric categories, the opportunity to leverage insights as a true competitive advantage is massive.

In categories where it’s par for the course, teams have to fight hard to discover belief systems that might carve out unique spaces for them in an ocean of sameness. In already sophisticated insights categories like Food and Beverage, Health and Supplements, even Cleaning, sophisticated insights that decode belief systems are critical to ward off threats and identify white space. But the gains are incremental and the pressure is stronger to defend than to create.

On the other hand, in less mature industries like Apparel, Alcohol and Spirits, Financial Services, Automotive, Luxury and Lifestyle Goods, Tobacco and Cannabis, Makeup and Skincare etc., even the slightest of gains in insights can have a significant impact, almost overnight.